Andrea Zaccaria

Researcher

- andrea.zaccaria@cnr.it

- +39 06 4991 3488

Andrea Zaccaria is a researcher at the Institute for Complex Systems-CNR in Rome. He received his Ph.D. in Physics at the “Sapienza” University of Rome, where he applied concepts and methods borrowed from statistical physics and the physics of complex systems to the study of financial markets. As a member of the research and development group of SoSE Spa, one of the main Italian fiscal agencies, he developed a machine learning algorithm to classify taxpayers and detect tax evasion. In his current role with ISC, Andrea is exploring the use of complex networks methodologies, algorithmic tools, and machine learning in the field of economics. This activity led Andrea to the appointment as a consultantat public and private organizations, including the cybersecurity startup Sharelock (www.sharelock.ai) and the International Finance Corporation-World Bank Group (www.ifc.org).

RESEARCH INTERESTS AND MAIN ACHIEVEMENTS

2013-present: Economic Complexity, an innovative, data-driven approach to Economics, combining complexity science and machine learning. This methodology has been adopted by the European Commission and the World Bank Group for the study of about 70 countries. In particular, I focused on:

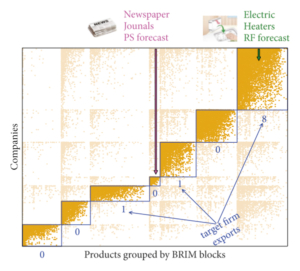

- The introduction of a directed network of products and dedicated machine learning approaches to study and predict the development of countries and companies.

- The investigation of the dynamics that make countries escape from the poverty trap.

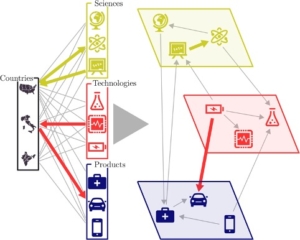

- A multilayer approach for the analysis of the interplay among Science, Technology, and Production that is able to connect, for instance, the patenting activity of a given country with its industrial production with a time delay of up to 30 years.

- Evidence that firms that diversify their patenting activity in a coherent way have higher productivity.

- Guest Editor of a special issue on the subject for the journal Entropy, title: Economic Fitness and Complexity (link: www.mdpi.com/journal/entropy/special_issues/Economic_Complexity).

2010-2015: Explanation of extreme price movements in terms of microstructural liquidity crises and study of the connection between traders’ strategies and various empirical properties of financial markets.

2011-2014: Analysis of financial time series, in particular:

- Introduction of a new stylized fact, particularly relevant for extreme events, and

- Empirical analysis to show that technical trading leads to memory effects in price dynamics.

2011-2013: Application of complexity tools (networks, agent-based models, and Kolmogorov complexity, among others) to the development of new income assessment systems for the Italian fiscal agencies. Elaboration of an original algorithm for the detection of tax evasion.

2008-2013: Development of a minimal agent-based model to extract the key features to explain the origin and self-organization of the main empirical properties of financial markets.

After The trickle down from environmental innovation to productive complexity, F. de Cunzo, A. Petri, A. Zaccaria and A. Sbardella, Sci. Rep. 12, 22141 (2022)

After Prediction and visualization of Mergers and Acquisitions using Economic Complexity, L. Arsini, M. Straccamore, A. Zaccaria, arXiv:2210.07292 (2022)

After Unfolding the innovation system for the development of countries: coevolution of Science, Technology and Production, E. Pugliese, G. Cimini, A.Patelli, A.Zaccaria, L. Pietronero and A. Gabrielli Sci. Rep. 9, 16440 (2019)

After Machine Learning to Assess Relatedness: The Advantage of Using Firm-Level Data, G. Albora and A. Zaccaria, Complexity, (2022).

LINKS

Full publication list from Google Scholar